Instead of a 30/50 pressure switch, use a 40/60 pressure switch with a 38-psi pre-charge, and the numbers look like this:ĭrawdown = (38 + 14.7) divided by (40 + 14.7) minus (38 + 14.7) divided by (60 + 14.7) x 85. As we will point out later, it is possible – though not always standard practice – to pre-charge conventional tanks.

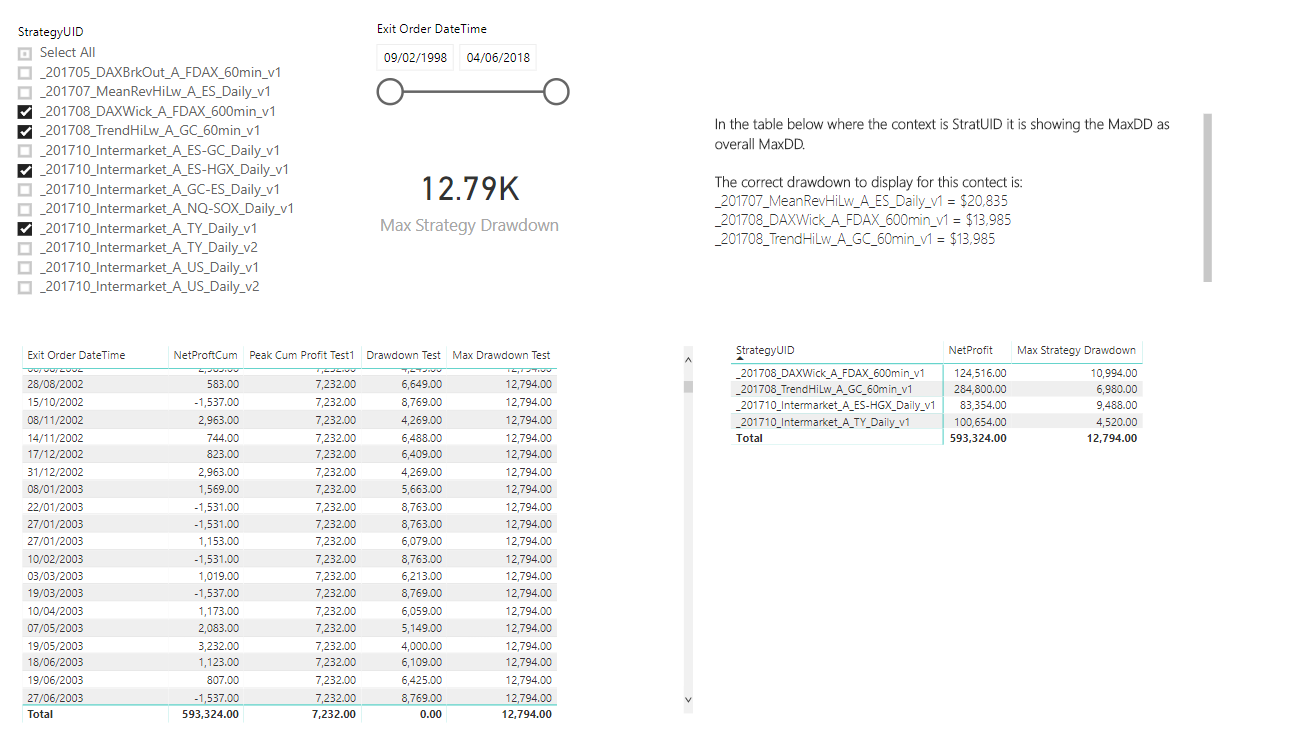

Imagine a 30/50 pressure switch, but no pre-charge, as could be the case with a conventional tank with no pre-charge.ĭrawdown = (0 + 14.7) / (30 + 14.7) – (0 + 14.7) / (50 + 14.7) x 85ĭrawdown = 0.102 x 85 = 8.7 gallons, about 10 percent of the total tank capacity. Use the same tank conditions, but put the job up at Lake Tahoe in California at 6,000 feet above sea level, where the atmospheric pressure is 11.8 psi, instead of 14.7 psi. Therefore, drawdown = 0.295 x 85 = 25.1 gallons. The drawdown formula then looks like this:ĭrawdown = (28 + 14.7) divided by (30 + 14.7) minus (28 + 14.7) divided by To make the calculations easier, Boyle’s Law can be restated as: At sea level, add 14.7 psi to the gauge pressure to get absolute pressure. Once you are done with these calculations, you can report the final statistics using Excel min/max function.Remember that all pressures must be stated in terms of absolute pressure. It is the difference between current equity and peak equity.Īnd column E will represent Drawdown %, which is nothing but the drawdown expressed in % of peak equity. It is simply the max of current equity and previous peak value.Ĭolumn D will contain the drawdown value.

Then, in column C you need to calculate ‘Peak Equity’ value. Suppose you put this information in columns A and B Calculate Drawdown in an Excel Sheetĭrawdown calculation in the Excel sheet is pretty simple and can be achieved through some simple mathematical formulas.įirst of all, you need to list down your total equity(capital) arranged in order of dates.

Drawdown formula excel how to#

The real deal is how to minimize these drawdowns, which is a different topic altogether and we’ll eventually cover it in another blog post. Now the stock drops from 120 to 110, that’s $10 off the highs and therefore a $10 or 8.3% drawdown from the so-called peak.Īny trading system or strategy is prone to drawdowns, you literally cannot have a system with zero drawdowns. Usually measured in % terms, drawdown tells you how much your equity declined from its peak value.įor example – You buy one stock at $100 and your first trade gave you a 20% profit. Although this metric is readily available in most of the modern backtesting tools, yet having it in Excel is going to add a lot of values for newbies.Īlso Read: How to plot a candlestick chart in an Excel Sheet? Understanding Drawdowns In this post, we’ll learn how to calculate drawdown in an excel sheet. A drawdown measures the peak to trough decline of your equity value during a specific period of time.

Drawdown is one of the most important measures for evaluating trading systems.

0 kommentar(er)

0 kommentar(er)